The latest patent data from 2025 tells a compelling story about the changing face of global innovation. While technology giants continue to dominate the rankings, the numbers reveal surprising shifts in strategy, investment, and perhaps even the future direction of the industry itself.

Samsung Takes the Crown

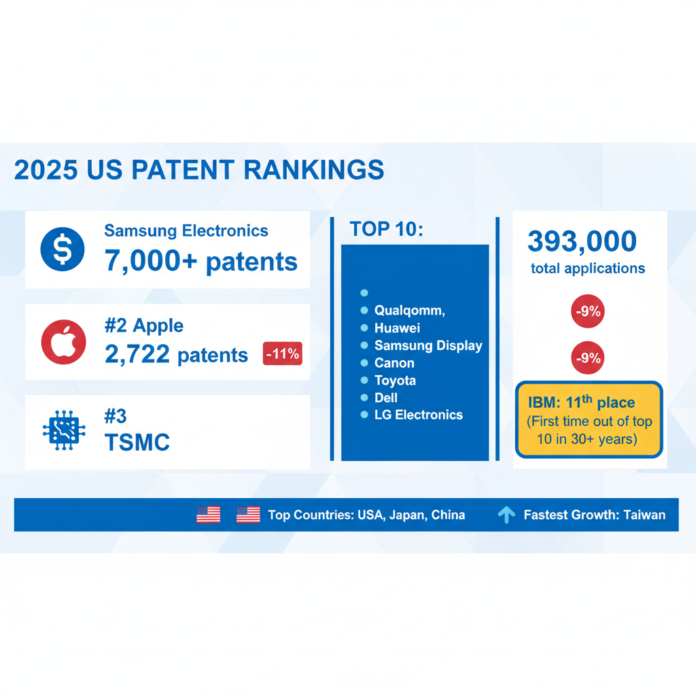

Samsung Electronics has emerged as the undisputed leader in patent acquisitions, securing more than 7,000 patents in the United States during 2025. This impressive achievement solidifies the South Korean conglomerate’s position not just as a consumer electronics powerhouse but as a serious innovator across multiple technological domains. From semiconductor manufacturing to display technology, from artificial intelligence to telecommunications infrastructure, Samsung’s patent portfolio reflects the company’s diverse interests and its commitment to maintaining technological leadership across the board.

The scale of Samsung’s achievement becomes even more apparent when compared to other industry players. With over 7,000 patents, the company has created a substantial gap between itself and the competition, demonstrating a level of research and development investment that few organizations can match.

Apple’s Strategic Recalibration

In contrast to Samsung’s dominance, Apple’s patent numbers tell a different story. The Cupertino-based tech giant received 2,722 patents in 2025, marking an 11% decrease from the previous year. Before jumping to conclusions about Apple’s innovative capacity, however, it’s worth considering what these numbers might actually represent.

Apple has long been known for a different approach to intellectual property compared to some of its competitors. Rather than filing patents for every incremental improvement or variation, the company has historically focused on strategic patent applications that protect core innovations and key differentiators. The decline in patent numbers could reflect several possibilities: a more selective approach to patent filing, a strategic shift in research priorities, or perhaps a focus on refining and commercializing existing technologies rather than pursuing entirely new directions.

It’s also worth noting that patent quantity doesn’t always correlate directly with innovation impact. Some of the most transformative products in recent history were protected by relatively few patents, while extensive patent portfolios sometimes reflect defensive strategies rather than groundbreaking innovation.

The Semiconductor Powerhouses

TSMC’s appearance in the top five is particularly noteworthy. As the world’s leading contract semiconductor manufacturer, TSMC doesn’t produce consumer-facing products, yet its innovation in chip manufacturing processes is absolutely critical to the entire tech industry. The company’s patents likely cover advanced manufacturing techniques, chip design methodologies, and process improvements that enable smaller, faster, and more efficient processors.

Qualcomm’s strong showing reinforces the continued importance of wireless communications technology. As 5G networks expand globally and research into 6G begins in earnest, Qualcomm’s patent portfolio positions the company at the center of the next generation of connectivity.

China and Taiwan Rise

Perhaps one of the most geopolitically significant aspects of the 2025 patent data is the strong performance of Asian companies, particularly those from China and Taiwan. Huawei’s presence in the top five is remarkable given the various challenges the company has faced in Western markets. Despite restrictions and controversies, Huawei continues to invest heavily in research and development, particularly in telecommunications infrastructure and smartphone technology.

Taiwan’s fastest growth rate among all regions is especially striking. Beyond TSMC’s individual success, this trend suggests a broader commitment to innovation across Taiwan’s technology sector. This growth trajectory has significant implications for global supply chains and technological leadership in the coming decades.

Traditional Giants Hold Ground

The presence of Canon and Toyota in the top ten reminds us that innovation extends far beyond smartphones and social media. Canon’s patents likely span imaging technology, optical systems, and industrial equipment, while Toyota’s portfolio undoubtedly includes significant work in electric vehicle technology, autonomous driving systems, and manufacturing processes.

Dell and LG Electronics round out the top ten, representing the continuing importance of computing hardware and consumer electronics, respectively.

IBM’s Historic Fall

Perhaps the most symbolic shift in the 2025 rankings is IBM’s fall from the top ten for the first time in over three decades. For generations, IBM was synonymous with corporate innovation and research excellence. The company’s fall to 11th place marks the end of an era and raises questions about the changing nature of innovation in the technology sector.

This shift might reflect IBM’s ongoing transformation from a hardware-focused company to one emphasizing cloud services, artificial intelligence consulting, and enterprise solutions—areas where patent volume may be less indicative of competitive position.

The Bigger Picture

The overall landscape shows approximately 393,000 patent applications filed in the United States in 2024, representing a 9% decrease from the previous year. This decline could reflect various factors: companies becoming more strategic about patent filings, economic uncertainties leading to reduced R&D spending, or perhaps a maturation of certain technology sectors where the pace of fundamental innovation has stabilized.

The dominance of companies from the United States, Japan, and China in patent counts reflects these nations’ continued investment in research and development. However, Taiwan’s rapid growth rate suggests that the innovation landscape continues to evolve, with new centers of technological development emerging.

Looking Forward

These patent rankings offer more than just a snapshot of current innovation—they provide clues about where technology is heading. The strong showing of semiconductor and display companies suggests continued emphasis on fundamental improvements in computing hardware. The presence of automotive manufacturers hints at the ongoing transformation of transportation. And the overall numbers remind us that despite headlines about any single breakthrough, innovation remains a marathon, not a sprint.

As we move deeper into 2025, these patent portfolios will begin to manifest as actual products and services. The true measure of innovation isn’t just in the patents filed, but in how those ideas transform into technologies that change how we live and work.